Investment Fees

Securities Division

4th Floor, 2365 Albert Street

Regina, SK, S4P 4K1

Tel: (306)787-5645

Fax: (306)787-5899

Email: fcaa@gov.sk.ca

Investment Fees

Fees are an important part of investing and can be often overlooked or misunderstood. Understanding fees and knowing what you paid to buy, sell or hold an investment can help you make more informed investment decisions.

- Why is understanding fees important?

- How fees impact your returns

- Types of fees

- Review your annual charges and compensation report

- Ask questions

Why is understanding fees important?

Fees are typically charged by dealers and advisers to cover the costs associated with administering investment products, operating your account, making transactions on your behalf, your account performance and/or offering advice.

It’s important to understand that fees have an impact on your investment returns. Fees are paid to your dealer or adviser which ultimately reduces your profit or may increase your losses. You pay fees regardless of whether you make money or lose money.

A small per cent change in fees can make a big difference on the value of your account in the long run.

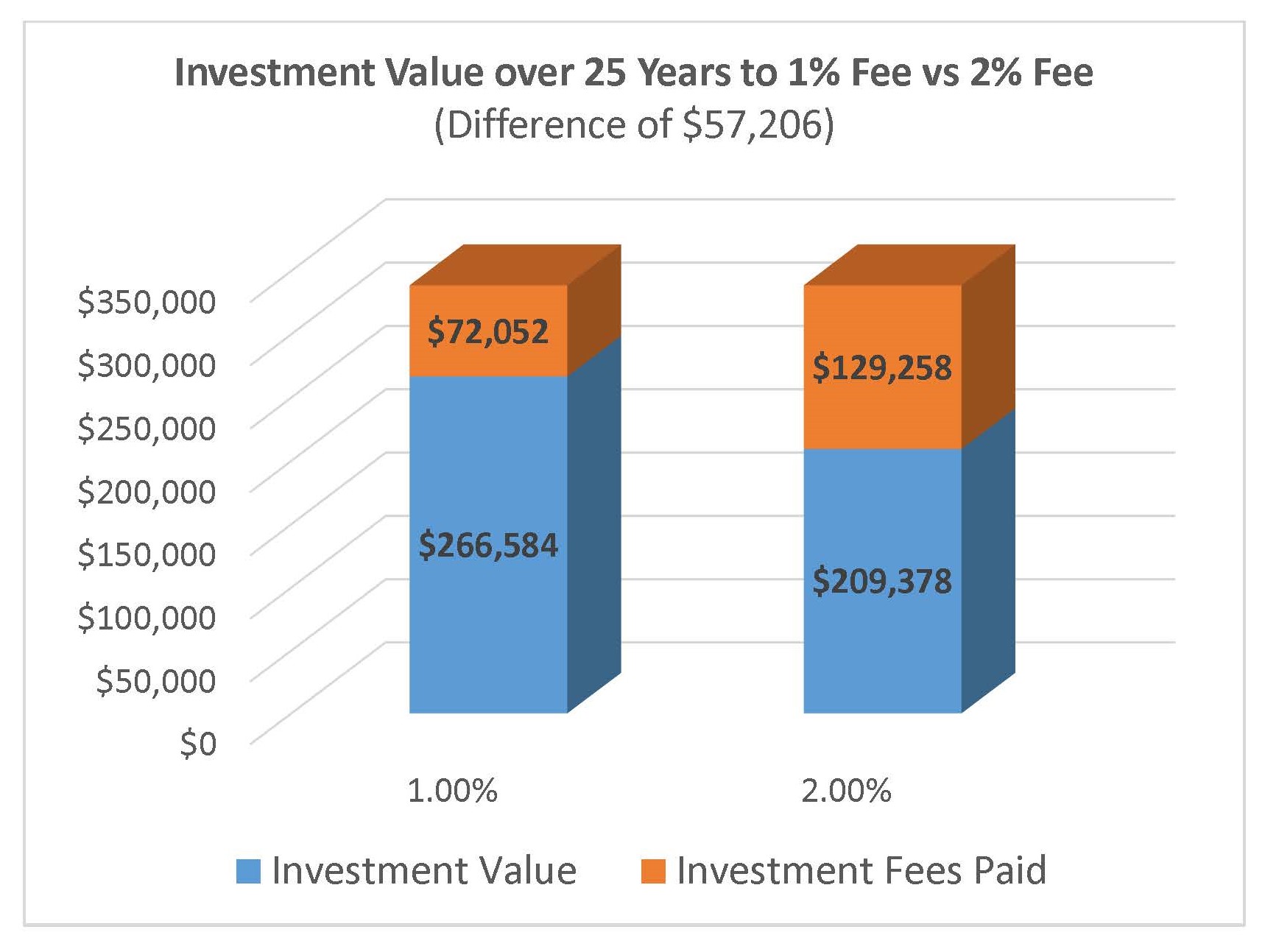

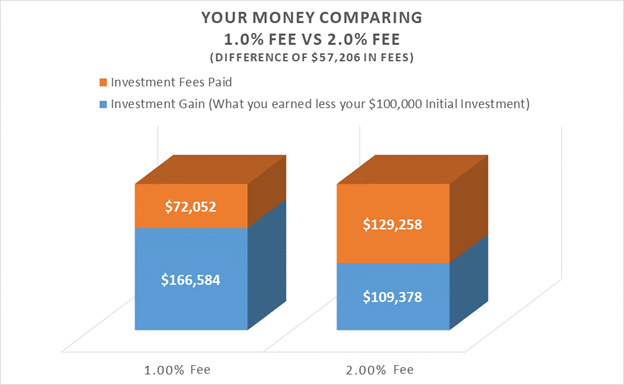

The charts below highlight how a 1% fee and a 2% fee can impact your return.

Assumptions:

- Initial Investment - $100,000 (no further contributions, no disbursements, no withdrawals)

- Annual return – 5%

- Term – 25 years

- Annual compound return minus fees (5%return-1% fee and 5%return-2%fee)

- These results are for reference only

This chart above outlines how the investment value over 25 years is impacted by a 1% vs a 2% investment fee. Both investment accounts are worth $338,636, but the 1% fee account has paid $57,206 less in fees compared to the 2% fee account.

This chart above outlines how the investment gain is impacted by a 1% vs a 2% investment fee after the initial $100,000 investment has been subtracted. The investor who paid a 1% investment account fee earned $57,206 dollars more than the investor who paid a 2% account fee.

Fees are typically charged by dealers and advisers to cover the costs associated with administering investment products, operating your account, making transactions on your behalf, your account performance and/or offering advice.

Here is a list of fees:

- Trailer fee/Trailing commission: A trailer fee or trailing commission is a charge paid on mutual funds and ETFs for services and advice provided by your dealer or adviser. You pay it as long as you hold the investment. The fee is paid out of the pool of the mutual fund’s assets and therefore reduces the return on the mutual fund. These fees are included in the Management expense ratio (MER).

- Management expense ratio (MER): Each mutual fund and Exchange Traded Fund (ETF) has an operating fee for legal, accounting, trailing commission and management expenses. The MER is the total of all expenses, expressed as an annual percentage of the value of the fund. The fee is paid out of the pool of the mutual fund’s assets and therefore reduces the return on the mutual fund.

- Brokerage commission: These are fees charged per transaction based on buying and selling stocks, bonds and ETFs.

- Management fee: A fee based on a percentage of the account’s value. This fee is negotiated at the beginning of your client-adviser relationship and pays for the cost of managing your overall account.

- Fees for service: An adviser may charge a set fee or flat fee for additional services that are not included in the management of your account.

- Discount Broker fee: If you have a “do it yourself account”, a discount broker will make trades on your behalf. A discount broker will charge a basic amount per trade but may also charge additional amounts related to the number of trades and the size of your account.

- Redemption fee: A fee that is charged when an investor sells mutual funds before a designated time period has elapsed. Charges paid at the time of redemption vary depending on how long you have held the fund.

- Sales charges: Some mutual funds charge you when you buy your units or shares (called front-end load or initial sales charge) and others charge you when you sell (called back-end load or deferred sales charges [DSC]). There are also low load funds, which have a lower sales charge when you sell your units or shares and no load funds, which don’t charge a fee when you buy or sell.

These are most of the fees that you might be charged. They may be under different names on your annual charges and compensation report. If you don’t understand your fees, talk to your dealer or adviser.

Review your annual charges and compensation report

- Your dealer or adviser should send you an annual charges and compensation report that summarizes all the fees you were charged including any compensation your dealer or adviser received from third parties based on your investments.

- While this report will show trailing fees it does not include all the elements of the management expense ratio (MER) at this time, such as legal and accounting fees. The MER information can be found in the mutual fund’s Fund Facts document or the exchanged traded fund’s ETF Facts document, or in the prospectus.

- Review the report and ask your dealer or adviser to explain the fees that have been charged and how they impact your returns.

-

Before you purchase an investment, ask about the fees and how they will impact your account.

-

Always ask your dealer or adviser to explain the fees on your account. If you don’t use a dealer or adviser, make sure you read the investment product’s prospectus, Fund Facts and ETF Facts or the financial institution’s website to get a better understanding of what fees you are being charged.

-

Make sure you receive and understand the disclosure you were given when you opened your account. This information includes how your dealer and your adviser are compensated, what services you will receive and the products that are available, the costs of your operating account, and whether there are any material conflicts of interests.

-

Always ask your dealer or adviser if there’s a lower fee option that’s right for you. Some fees may be negotiable.

-

If you use an online adviser or discount brokerage service make sure to understand what you are paying for when using their services. Even though these fees may be less than you would pay a dealer or adviser, the fees or charges can impact your investment returns.

Securities Division

4th Floor, 2365 Albert Street

Regina, SK, S4P 4K1

Tel: (306)787-5645

Fax: (306)787-5899

Email: fcaa@gov.sk.ca